It is predicted that Jiangsu Yangnong’s

5,000 t/a dicamba project will be put into regular production in H1 2015, which

will bring considerable income and profit to Jiangsu Yangnong.

Recently, some industry insiders believed

that Jiangsu Yangnong Chemical Co., Ltd. (Jiangsu Yangnong)’s dicamba project

(5,000 t/a) will be put into regular production in H1 2015. Jiangsu Youjia

Plant Protection Co., Ltd. (Jiangsu Youjia), the subsidiary of Jiangsu

Yangnong, will be responsible for implementing the project.

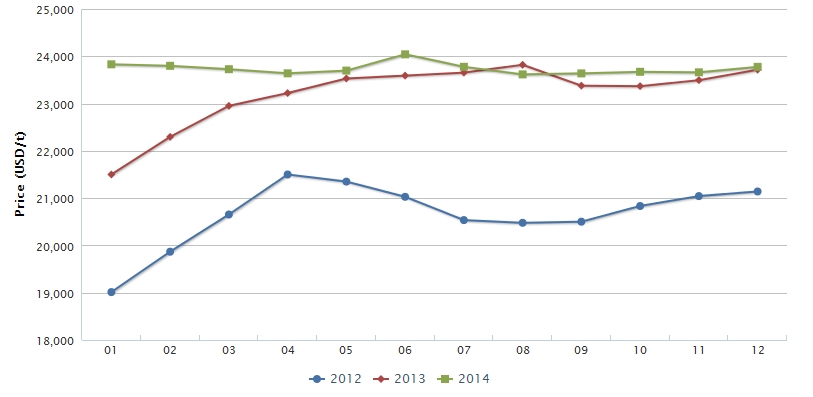

Ex-works prices of 98% dicamba TC in China, Jan. 2013–Dec. 2014

Source : CCM

According to the information released by

the Government Affairs Service Center of Rudong County, Jiangsu Province in

Dec. 2014, Jiangsu Youjia has completed the equipment installation and testing

for the dicamba project (5,000 t/a) in Sept. 2014, which was ready to enter

into commissioning. At the same time, its projects of bifenthrin (800 t/a),

fluazinam (600 t/a) and 3,3- dimethyl-4-pentenoic acid (5,000 t/a) were also

ready for trial production. (For more information of Jiangsu Yangnong’s dicamba

project, please refer to Jiangsu Yangnong to launch 5,000t/a dicamba TC

production line, Herbicides China News 1312.)

It is revealed that dicamba products will

be the strength of Jiangsu Yangnong’s future performance growth. In the near

future, the production capacity of the company’s dicamba project will be

completely released. At that time, the production capacity of Jiangsu

Yangnong’s dicamba TC will reach 6,200 t/a, which will ease the current tight

supply of dicamba. Meantime, industry analyst believed that the dicamba project

will bring considerable income and profit to Jiangsu Yangnong.

In view of the market price of dicamba, in

recent years, China’s dicamba price witnesses upward trend. According to the

price monitoring of CCM, the price of 98% dicamba TC was increased to

USD23,775/t in Dec. 2014 from USD19,031/t in Jan. 2012. If the price of dicamba

TC remains unchanged, coupled with that Jiangsu Yangnong’s dicamba production

line (5,000 t/a) realizes full production and products are completed sold, this

dicamba production line will help Jiangsu Yangnong earn USD119 million

annually. It is worth noting that according to the Taxation (2014) No.150, from

1 Jan., 2015, the export tax rebate rate of dicamba TC will increase to 13%

from 9%. That is to say, Jiangsu Yangnong will make more profit under the help

of the policy.

It is disclosed that the dicamba demand

will increase in the future, affected by the intensifying problem of glyphosate

resistant weeds, the approved dicamba transgenic trait of Monsanto Company in

the US and the upcoming commercialization of dicamba genetically modified

soybean and cotton varieties. Industry insiders predicted that the market

demand for dicamba will increase to about 50,000 tonnes from 15,000 tonnes in

the future. (For more analysis on future demand for dicamba, please refer to

Dicamba to be growth point in herbicide market, Herbicides China News 1407.)

Jiangsu Yangnong enjoys advantages in the

diacmba production in China. Firstly, since Jiangsu Yangnong’s dichloro-benzene

and trichloro-benzene (raw materials for dicamba) are purchased from parent

company Jiangsu Yangnong Chemical Group Co., Ltd. (Yangnong Group, the only

producer for dichloro-benzene and trichloro-benzene in China), the production

cost of diacmba is low. Secondly, Jiangsu Yangnong masters the complicated

technique of diacmba dichloro-benzene at high level, which reduced the

production cost to nearly the same as that of trichloro-benzene process.

Additionally, Jiangsu Yangnong invested much in the environmental protection to

ensure that the Three Wastes (industrial wastewater, waste gases and residues)

emission meets the standard.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in

touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: herbicide